What is the difference between Tether printing money and a private organization like the Federal Reserve printing money? Nothing.

And increasingly, Tether is becoming the new Fed, as it has now announced that it is entering the precious metals market.

The company just published its first attestation report for Tether Gold (XAUT), showing 7.7 tons of physical gold locked down as collateral. It’s a bold move to bring receipts in a market that doesn’t hand out trust easily.

A Glimpse into Tether Gold’s Market Strength

Tether Gold (XAUT) is now officially backed by more than 7.7 tons of physical gold, according to a third-party attestation from BDO Italia released Monday. That’s over $800 million in value.

So who knows — maybe Tether is becoming better than the Fed?

Riding a broader shift toward hard assets, XAUT rose from $3,123 to $3,344 between late March and April, pushing its market cap to $825 million. As XAUT grows, gold is having a moment—and so is tokenized gold.

@Tether_to released its first official attestation for Tether Gold ( $XAUT ) for Q1 2025:

– 7.7 tons of gold backing 246,523 XAU₮ tokens

– $770M market cap

– Fully regulated in El Salvador

– Each token = 1 troy ounce of real gold stored in Switzerland. pic.twitter.com/7PZRATpWfQ— Satoshi Club (@esatoshiclub) April 28, 2025

Tether CEO Paolo Ardoino made sure to fan the flames, jumping on social media to frame XAUT as the stablecoin world’s golden alternative.

“While central banks are stacking up hundreds of tons of gold, XAUT is set to become the standard tokenized gold product for the people and institutions,” said Ardoino.

His statement comes as central banks increasingly pivot toward gold. A report from the World Gold Council revealed that 29% of central banks plan to boost their gold reserves within the next year.

Why Tether XAUT and Gold Are Gaining Ground

Digital gold solves a few old problems: no vaults, no insurance premiums, no shipping. XAUT promises bullion without the baggage.

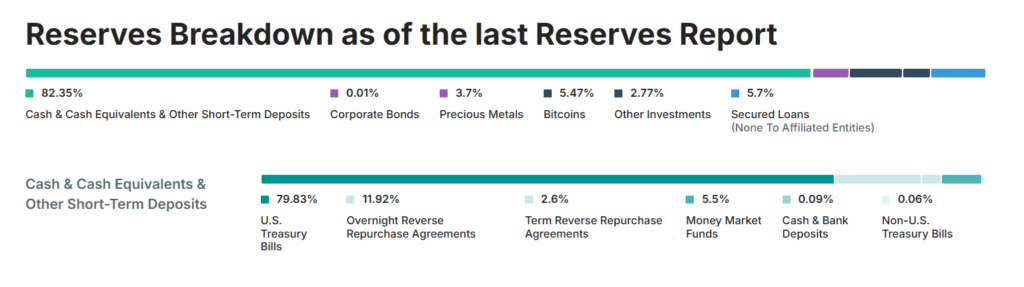

But Tether’s path to legitimacy is still under review. The recent attestation confirms the gold exists—but critics say it’s not enough. The lack of deeper financial disclosures continues to raise eyebrows, echoing familiar concerns from the USDT debate.

(Tether Reserves)

Even so, it seems like Tether is finally trying to clean up its act. With Paxos and others circling the same space, competition could finally force the tokenized gold market to tighten up—or flame out.

The New Digital Standard?

XAUT gives risk-averse capital a path into crypto without leaving gold behind.

Whether it becomes a flagship or just a flashy side bet, one thing’s obvious: gold on-chain is starting to trend.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Increasingly, Tether is becoming the new Fed, as it has now announced that it is entering the precious metals market.

- Tether Gold (XAUT) is now officially backed by more than 7.7 tons of physical gold, according to a third-party attestation from BDO Italia released Monday.

- XAUT gives risk-averse capital a path into crypto without leaving gold behind. .

The post Tether Own Over $800M In Gold: A Look Inside Tether’s Gold Reserve appeared first on 99Bitcoins.