Coinbase CEO Brian Armstrong has made a bold prediction. He took to X to say that the crypto market’s total addressable market (TAM) will expand 100x as more legitimate companies join the space.

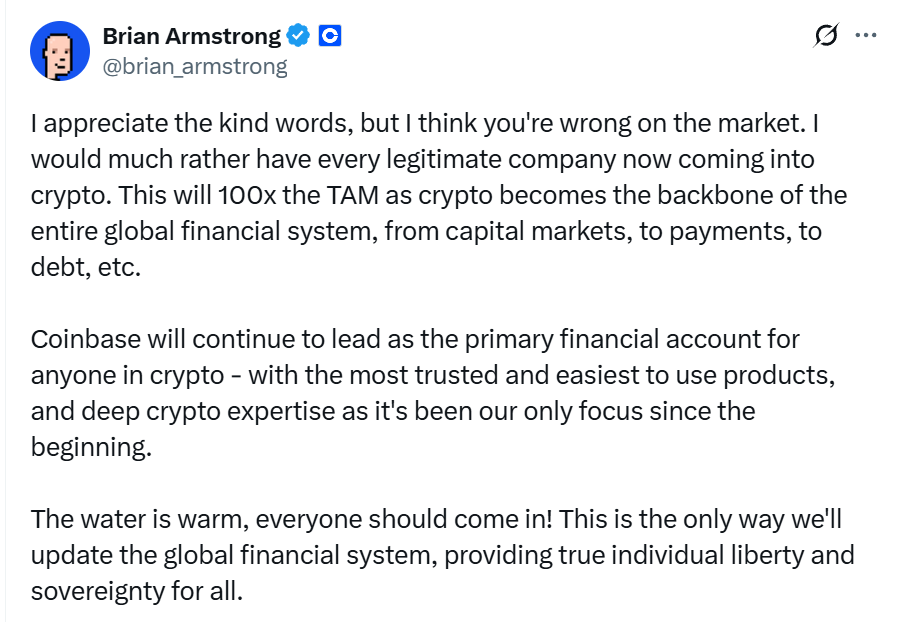

“I would much rather have every legitimate company now coming into crypto. This will 100x the TAM as crypto becomes the backbone of the entire global financial system, from capital markets, to payments, to debt, etc,” said Armstrong, replying to a lawyer and crypto investor loganb.sui.

According to @loganb.sui, “It’s under-appreciated just how much @coinbase has done for the industry in the last four years from a legal and policy perspective.”

The user went on to say that now the new admin is friendlier, the new SEC is constructive, and the results of this will be regulatoroy clarity, a consequent scaling of the industry, a greater institutional engagement with the industry, and a general maturation.

“However, it will also inevitably and undoubtedly mean ever-increasing, intense competition for every aspect of Coinbase’s business,” the user concluded.

It’s under-appreciated just how much @coinbase has done for the industry in the last four years from a legal and policy perspective. Especially since the fruits of this labor, though profoundly beneficial to the entire space, will likely hurt $COIN in the market.

For a long…

— loganb.sui (@TheWhyOfFI) April 28, 2025

Replying to this Armstrong said, The water is warm, everyone should come in! This is the only way we’ll update the global financial system, providing true individual liberty and sovereignty for all.

Explore: Top Solana Meme Coins to Buy in 2025

Coinbase Asset Management Prepares To Launch Bitcoin Yield Fund

COINBASE TO OFFER YIELD.

Goal is 4-8% yield.

Here are things you should know:

Bitcoin does not generate yield.

COINBASE will attempt to collect arbitrage on a basis trade between support and futures.

This will be called The Bitcoin Yield fund.

Deposit Bitcoin, withdraw… pic.twitter.com/NslY7UcQYz

— George Bodine (@Jethroe111) April 28, 2025

A 28 April 2025 Bloomberg report revealed that the Coinbase Asset Management is preparing to launch a Bitcoin yield fund on 1 May 2025. Apparently, Coinbase will exclusively target non-US institutional investors and give them another way to earn yield on their Bitcoin holdings.

Commenting on the new release, Sebastian Bea, President of Coinbase Asset Management said, “We believe the Bitcoin Yield Fund is particularly well suited to the task, given its conservative and compliant investment strategy.”

Armstrong added, “Coinbase will continue to lead as the primary financial account for anyone in crypto – with the most trusted and easiest to use products, and deep crypto expertise as it’s been our only focus since the beginning.”

Explore: The 12+ Hottest Crypto Presales to Buy Right Now

Key Takeaways

-

Armstrong’s comments come as the crypto market shakes off years of regulatory turbulence and reputational setbacks.

-

Coinbase, with its 66% share of the US crypto trading market and around 10 million users, is well-positioned to benefit from this next phase, even as it faces new rivals.

The post “The water is warm, everyone should come in,” Says Brian Armstrong As Coinbase Prepares To Launch Bitcoin Yield Fund appeared first on 99Bitcoins.